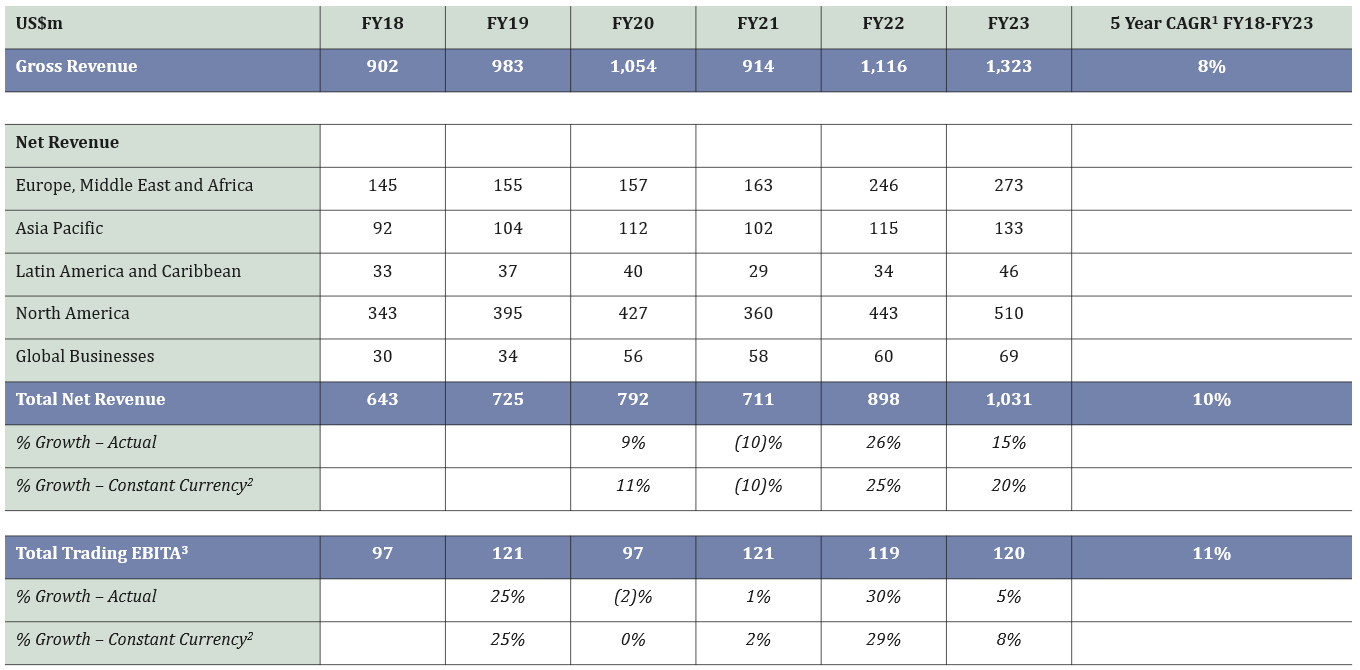

After exceptional performance in FY22, with 25% trading net revenue growth and 29% trading profit growth, FY23 was a strong year. At management budgeted exchange rates, our trading net revenue increased by 20% during FY23. Our trading profit increased by 8%, as we took the decision to invest in parts of the business (principally Digital, IT and HR) to create a platform for accelerated growth in future years.

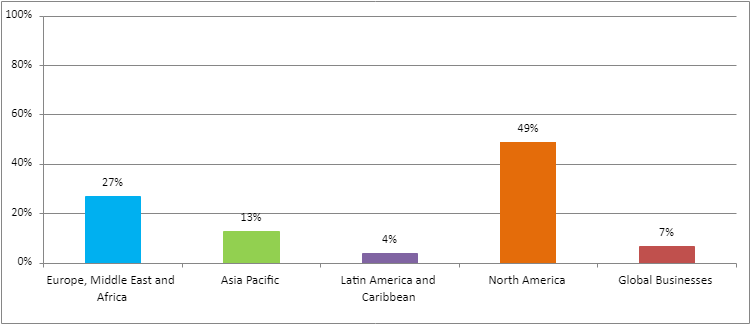

We continued to see growing demand for ERM’s services during FY23 and an unprecedented opportunity to influence the global sustainability agenda. We reached record levels of both backlog and weighted pipeline with investment in our Group Key Client program, increasing diversification into Power, Chemical and TMT sectors and longstanding recurrent relationships with a large and diverse blue chip client base (the majority of our work is sole source). Our highly diversified and balanced business model across sectors, clients and geographies allowed us to gain market share in a rapid growing market environment. Across our services, Corporate Sustainability & Climate Change saw the largest growth on prior year and Capital Project Delivery is our largest single service line. During FY23 we reshaped our focus in Digital from dominant expectation of software licensing revenues to a more balanced mix of technology enablement of our core consulting business and digital products.

We continued to maintain significant investment for medium-term growth in key areas, including technology enablement of some of our services, and in growth sectors such as Chemical, Power and Technology, as well as the development of our client-focused service offerings. Increased stakeholder pressure is forcing corporates to view sustainability and ESG as a way to create value and gain competitive advantages. We have invested in developing offerings in this space by making key hires and via acquisitions. The six acquisitions made during FY23 have materially strengthened and broadened our capabilities, particularly in the Renewables, Digital and Low Carbon Economy Transition (“LCET”) space.

Full-time equivalent (“FTE”) employees increased by 1,000 during FY23, including 284 who joined the Group via our acquisitions. The market was strong during FY23 and we increased our FTEs in response to the improving market conditions and as a result of the increase in backlog. We ended the year at 7,502 FTEs.

Partners: Partners in ERM are our senior management level leaders. We hired 109 Partners during FY23 which provides us with a strong platform to grow the business over the medium-term. We also promoted 29 Partners from our Path to Partnership programme and brought in 18 Partners through acquisitions during the year.

Sustainability: We continue to play a leading role in the global sustainability agenda. Our 2024 Sustainability Report was issued in July 2024; this is our seventh report aligned with the Global Reporting Initiative’s (“GRI”) Standards and our thirteenth annual public report. Our latest Sustainability Report is available online at https://www.erm.com/sustainability-report.

Acquisitions: We continued to make strategic acquisitions, successfully acquiring six businesses during:

(i) On 1 April 2022, ERM completed the acquisition of Point Advisory, a leading Australian climate change and sustainability consultancy offering strategic and technical advice to businesses in the region. This acquisition will enhance ERM’s ability to support clients across Australia and the broader APAC market, as organizations increasingly seek to operationalize sustainability.

(ii) On 30 June 2022, ERM completed the acquisition of MarineSpace, a marine planning and environmental consultancy that provides specialist advice and services to clients across a range of sectors. This acquisition will enable ERM to offer consulting services to marine developers globally. These include offshore renewables projects from corporate strategy through to consent, operation, and decommissioning.

(iii) On 30 September 2022, ERM completed the acquisition of Shelton Communications Group, a sustainability-focused marketing and communications agency based in Knoxville, Tennessee who offer a unique blend of capabilities to help organizations communicate their sustainability credentials to customers, communities, employees, and investors. The acquisition will strengthen ERM’s ability to provide clients with integrated solutions across the spectrum of their sustainability needs.

(iv) On 2 December 2022, ERM completed the acquisition of Libryo, a global cloud-based Environmental Health & Safety (EHS) regulatory intelligence platform that helps organizations manage the different legal requirements that apply to their business in every jurisdiction. Libryo’s team of technology and regulatory experts will work alongside ERM’s global sustainability advisory teams to offer clients a comprehensive solution to their compliance requirements.

(v) On 3 February 2023, ERM completed the acquisition of Coho Climate Advisors, a global advisory firm with expertise in helping organizations reach their climate change, renewable energy, and water resiliency goals. Combined with ERM’s strategic transformation and technical delivery capabilities, the acquisition will provide clients with further support to deliver their climate goals and realize the commercial opportunities presented by decarbonization and water optimization.

(vi) On 27 February 2023, ERM completed the acquisition of NINT – Natural Intelligence, a Latin America-based consultancy providing sustainable finance and ESG advisory services with a focus on financial institutions, corporations, and other key organizations in the financial sector. NINT brings a blend of business and technical skills at the intersection of strategy, finance, and sustainability advisory to enhance ERM’s end-to-end solutions for investors, issuers, and stakeholders in Latin America.

Future developments

We believe that, despite current economic uncertainty, ERM has an extraordinary growth opportunity, and commensurate challenge, ahead of us in the next financial year and beyond. While the outlook for the consulting sector in the medium term is mixed, the Directors are confident of achieving the FY24 budgeted growth which is supported by record backlog, a track record of FTE growth in FY23 and a diversified service and sector client base.

Client demand is buoyed by LCET and ESG market drivers and we believe we are on the cusp of a new age of growth. We will leverage our exposure to a large growth industry with a strong focus on the ESG theme and proliferation of 'sustainability' and 'social responsibility' trends driving visible non-discretionary revenue streams.

We will continue with our strategy, which is to grow and build our presence in major markets, through organic growth and targeting specific acquisitions where appropriate to broaden our geographic and service offerings. Our global expansion focuses on building deep and lasting relationships with our clients and servicing their needs in more regions and across more service areas.

As part of the KKR Transaction in the previous year we set out an ambitious five year growth plan. In order to achieve this, our future investment activities will include:

- The ongoing development of our client relationship programme

- Expanding our key service offerings so that we are positioned to gain from the proliferation of Sustainability, Climate Change, LCET and ESG super-trends

- Continued focus on inorganic growth from acquisitions

- Expanding the role of technology and data in our service offerings and in our operational delivery

- The ongoing hiring of new Partners from outside ERM, as well as annual internal promotions and inflow of Partners from new acquisitions

- Development of key areas such as cyber, risk, DE&I and brand to align with the Group’s growth ambitions.

Summary

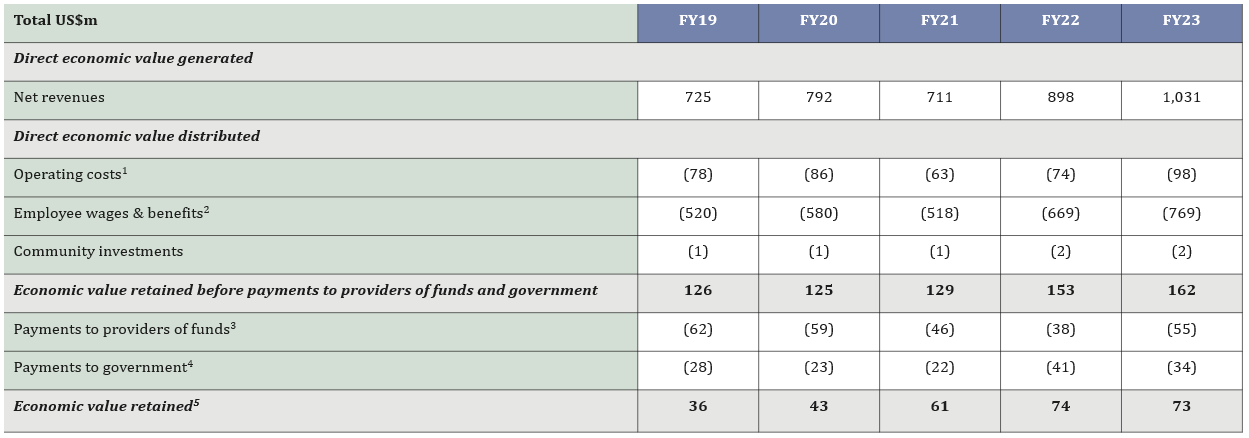

The financial year ended 31 March 2023 saw us successfully grow net revenue and use this momentum to make investments in our business to set us up for further growth in future years. We are optimistic about the future given the increased awareness of sustainability and growth in the market. Diversification has created a more balanced portfolio with reduced concentration risk in sectors, service lines, geography and customers. Demand for ERM’s services is evolving in a dynamic market environment and this demand is to some extent decoupled from levels of underlying economic growth where these services are now seen as mission critical and strategic for our customers. We remain excited by the opportunities ahead for us and we are maintaining investment and growing client relationships. We are well structured and financed and have strong current liquidity to ensure our business continues to thrive.