Managing compliance risk as a minimum, while also understanding the financial impacts, commercial opportunities and reputational risks sustainability disclosure could pose to the business should all now be key considerations for CFOs.

The importance of sustainability performance and disclosure to business is set to only increase as sustainability-related risks and opportunities relating to environmental and social performance have become inextricably linked to corporate strategy and operations. Most of the top risks to business and the economy globally are now interconnected sustainability-related risks, such as those linked to climate change, biodiversity loss and societal issues.

The CFO and the finance teams they lead are crucial in helping their organizations meet evolving sustainability disclosure and performance expectations from regulators, investors, customers and other stakeholders.

Companies that can leverage science-backed, high-quality data to manage and explain their sustainability performance will be well placed to differentiate their products or services and create competitive advantage such as access to new sources of green finance, increased market share, enterprise value and protection from greenwashing accusations.

In this context, CFOs now have a broader role to play in helping their companies to manage, monitor and report on enterprise value creation, as relevant to a wider group of stakeholders. CFOs are well placed to contribute to sustainability performance and disclosure in a range of ways including:

- Sustainability data management – helping ensure the quality of sustainability data reported from their team and that data is reported in a stakeholder-appropriate manner. Being able to do so requires CFOs and their finance teams to stay on top of the sustainability reporting requirements linked to new and upcoming regulations and ensure that, where required, disclosure information is assured by a qualified independent third-party assurance provider. It also requires maintaining a dialogue with investors and ESG raters and rankers to understand their sustainability-related data requirements.

- Enterprise risk management – as a C-suite member working with the executive team, CFOs can help ensure material sustainability-related risks and opportunities are integrated into their organizations’ enterprise risk management processes. They also have a responsibility to ensure that strategic responses are developed to manage material sustainability-related risks and opportunities and that these responses are integrated into corporate strategy.

- Access to finance - having robust sustainability data can enable the organization to access new forms of sustainable finance. CFOs can help their organizations seize new opportunities in this area through developing their company’s understanding of the range of sustainable financial products, identifying those that are best aligned with the companies’ needs and engaging lenders to discuss new sustainable finance options.

- Transition plan development and implementation - achieving sustainability-related goals, such as net zero targets, will require organizations to successfully implement a detailed transition plan. This integrates both a top-down analysis of the optimal mix between financial cost and sustainability impact potential of different possible interventions with bottom-up activities that empower an organization’s personnel to drive performance improvement in the areas where they work and have first-hand knowledge.

Developing a detailed transition plan that focuses not just on the organization’s own operations but also its broader value chain will enable the organization to manage financial, compliance and reputational risks, capitalize on opportunities to develop new services or products, reduce costs and enable others in its value chain, such as suppliers and customers, to reduce emissions and improve performance. Given that the financial costs and opportunities for most organizations will be significant, the CFO has a critical role to play in helping ensure their organization develops and implements a successful transition plan.

Taking steps to improve disclosure

With sustainability data increasingly reported in the annual report, CFOs are becoming responsible for their organizations’ reporting on a broad range of sustainability-related information, as well as leading financing, capital allocation and strategic decision making, based on sustainability data.

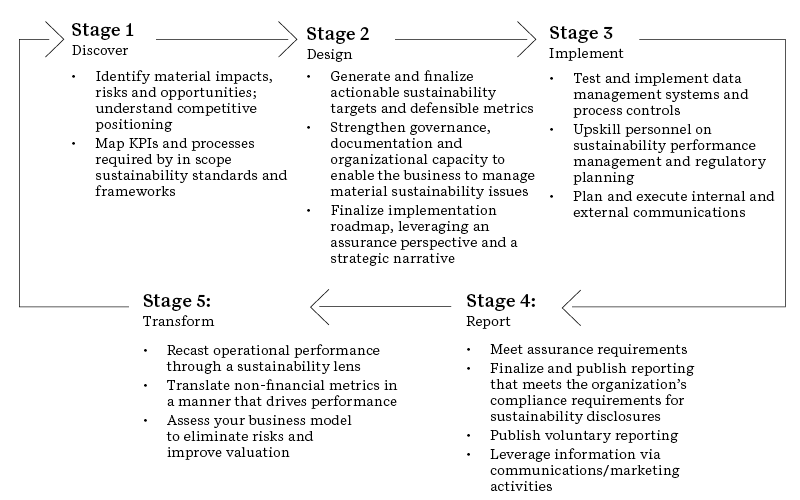

Following the five steps below will position companies well in their sustainability performance and disclosure journey:

Discover: achieve a comprehensive understanding of the company’s position with respect to the sustainability standards and frameworks relevant to the organization and the associated reporting requirements, assessment gaps and material issues.

Design: develop an approach to disclosure and translate this into business outcomes, including effective communication and engagement strategies.

Implement: utilize technological resources and tools to build and execute communication and engagement plans and integrate the requirements of sustainability standards and frameworks into operational site level management systems.

Report: disclose the required sustainability information on a timely basis and ensure any findings from independent third-party assurance are understood and acted upon.

Transform: leverage insights from the previous four steps to drive business benefits including enhanced product offering, purposeful stakeholder engagement and use non-financial metrics to drive business and sustainability impact performance improvement.

Sustainability disclosure as an opportunity for continuous performance improvement:

CFOs should start now to prepare for impending reporting requirements

The details of upcoming sustainability reporting requirements such as the EU Corporate Sustainability Reporting Directive (CSRD) are complex, but regulators won’t expect reporting to be perfect from the start. Rather, they will expect an honest attempt to make a good start. Conducting a gap assessment of the company’s readiness to disclose is a great way for an organization to take a critical first step toward compliance.

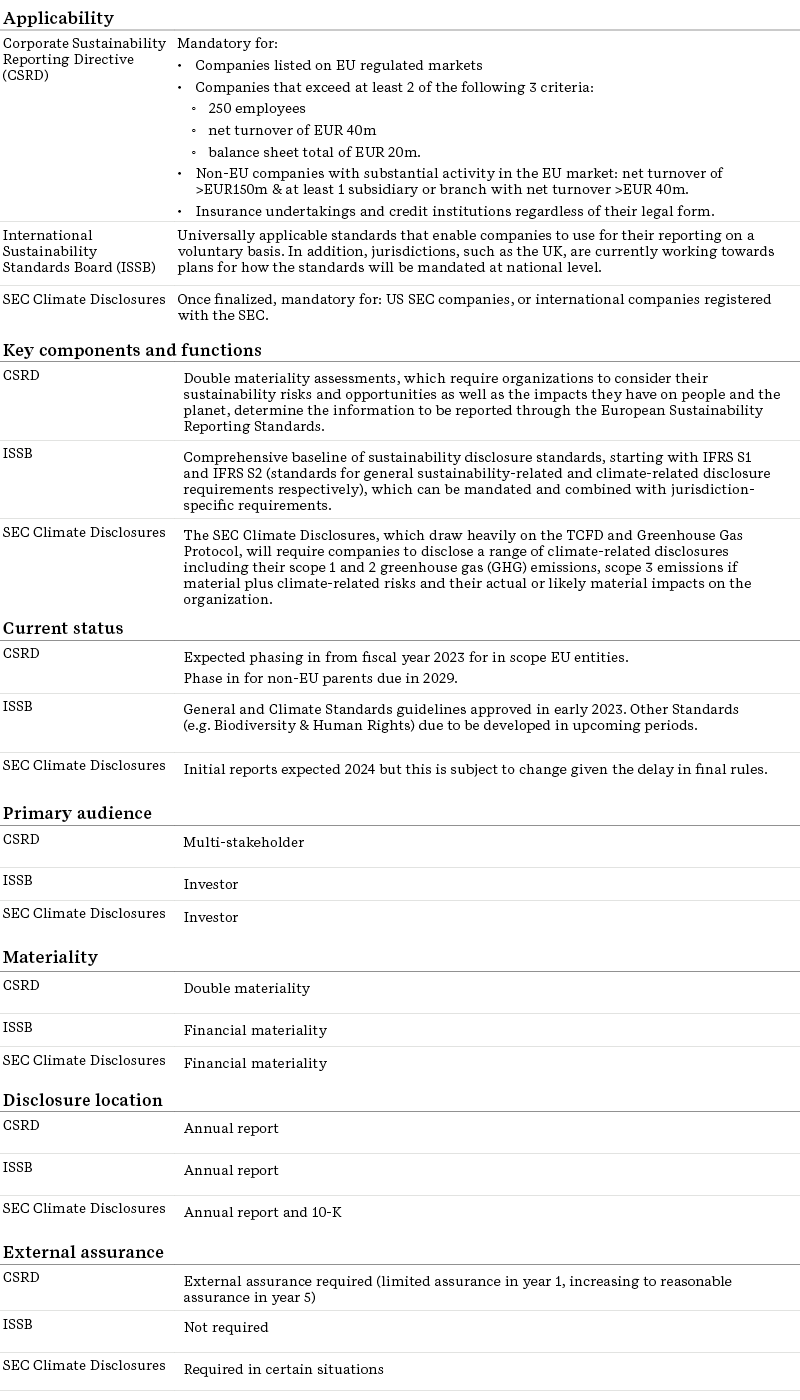

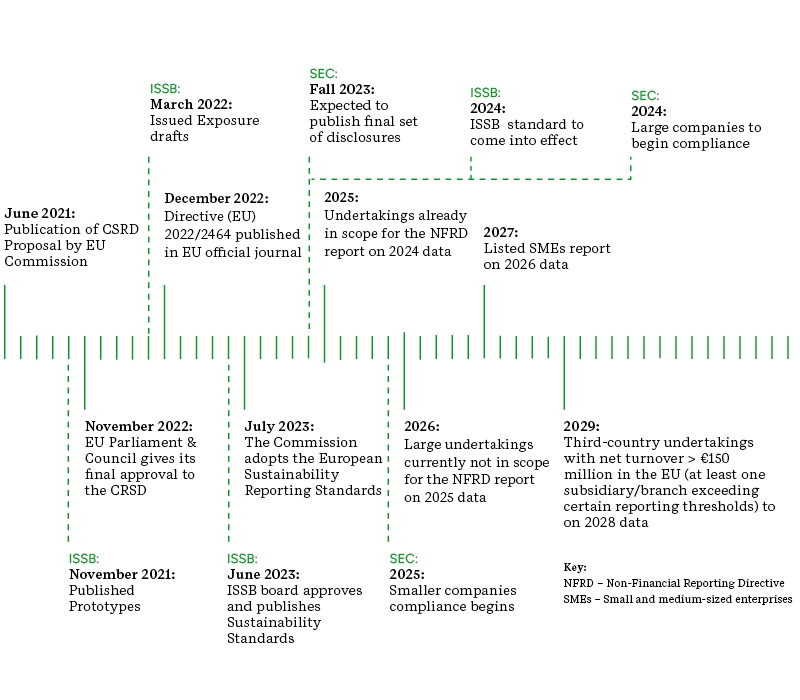

Reporting timelines will vary for companies, based on size and scope and according to applicable sustainability regulations and frameworks. Table 1 provides a summary of three of the main upcoming sustainability disclosure frameworks, including which types of organizations are in scope and the effective date.

Regardless of whether companies are immediately within scope of mandatory reporting, CFOs and their finance teams will benefit from leveraging the latest sustainability standards and frameworks for their internal and external reporting on a voluntary basis. Taking this approach will mean their organization’s data will be readily understood to many stakeholders, facilitating comparability with peers. It can also help future-proof organizations that will be brought into mandatory reporting in subsequent reporting cycles.

Key sustainability reporting regulations and frameworks

The sustainability reporting landscape continues to evolve and there have been important regulatory and framework updates, including from reporting initiatives in the EU, US and globally. Some of these are summarized in the table below.

Many jurisdictions, as in the draft SEC climate disclosure rule, have started to mandate climate-related financial reporting in line with the Taskforce on Climate-related Financial Disclosures (TCFD) recommendations. In the UK, premium-listed companies have been required to report on a “comply or explain” basis on whether their disclosures meet the recommendations of the TCFD since 2021. The UK requirement was extended to standard- listed companies the following year. Similar global mandatory disclosure requirements may eventually apply in the use of the new Taskforce on Nature-related Financial Disclosures (TNFD), released in September 2023.

Table 1: Summary of key reporting frameworks Hide

Common themes between the different sustainability standards and frameworks

Despite some important differences between the main sustainability standards and frameworks, common themes include:

- a clear direction of travel towards more standardization between frameworks

- a climate-first approach

- increased focus on scope 3 GHG reporting, which includes companies’ supply chains

- increasing focus on the importance of external assurance and mandatory

CSRD: sustainability data disclosure in the spotlight

One of the most important sustainability reporting requirements that will impact CFOs is the EU’s CSRD. The CSRD will impact organizations not just in the EU but also in the UK and globally. According to data from Refinitiv, at least 10,000 organizations headquartered outside the EU will likely have to comply - 31% of these are in the US and 11% in the UK. Though initially only in-scope entities will have to comply, parent companies will eventually be required to report on their entire global operations and not just those located in the EU.

The first CSRD reports are due on 2024 fiscal year data. Reporting entails up to 1,000 non- financial data points and requires companies to run a double materiality assessment on both financial and sustainability impact materiality before identifying what to report in their core annual report.

In addition, the disclosure requirements for transition plans in the CSRD, contained within the European Sustainable Reporting Standards (ESRS), in particular E1 Climate change, E4 Biodiversity and ecosystems and E5 Resource use and circular economy, will require organizations to gradually merge strategy and business model with sustainability strategy. This brings the financial and non-financial strategic implications of climate change mitigation and respect of planetary boundaries of the biosphere into the domain of the CFO and finance function.

The move to increased sustainability reporting in the annual report also coincides with a trend towards increased external assurance. Under the CSRD, external assurance will be mandated for all in-scope companies for their reporting years starting on or after 1 January 2024. Assurance will initially be at a limited assurance level but with the intent that companies will need to progress to reasonable assurance by 2028 fiscal year. This requirement will pressure-test the limited number of qualified independent third- party verifiers, particularly those with the appropriate technical depth in non-financial information. There is also a clear trend towards digitalization – under the CSRD, reporting entities will need to report in a digital format aligned with XBRL.

The development of the CSRD compliments other recently launched EU sustainability initiatives, aimed at the finance sector, including:

- the EU taxonomy, a classification system which came into force in 2020, established to clarify which investments are environmentally sustainable, in the context of the European Green Deal. The aim of the taxonomy is to help prevent greenwashing and to help investors make greener choices. Investments are judged by six objectives: climate change mitigation, climate change adaption, the circular economy, pollution, effect on water and biodiversity.

- the EU’s Sustainable Finance Disclosure Requirements (SFDR), which seeks to force financial institutions to publicly explain how they are approaching sustainability topics and goals in their products, so that key stakeholder groups including regulators and consumers can more easily assess the credibility and ambition of those claims. SFDR requires managers to assess and disclose how sustainability risks are considered in their investment processes, and how they consider investment decisions that might result in negative effects on sustainability factors, known as Principal Adverse

The EU is set to continue adding further rules and raising the bar for companies on sustainability. The European Parliament approved the Corporate Sustainability Due Diligence Directive in 2023, requiring companies to address sustainability challenges throughout their supply chain and report on improvement. As these examples show, the regulatory environment is rapidly evolving, and CFOs at many organizations that are either headquartered in the EU or with a significant presence there, will need to ensure that their organizations meet mandatory sustainability reporting requirements and broader stakeholder expectations.

Integrating sustainability into business operations

Below is a list of key questions to be considered by CFOs and their finance teams when operationalizing sustainability disclosures based on what ERM commonly sees in the market:

- Which sustainability aspects within our business and value chain may negatively impact the valuation of the company? What can be done to avoid or mitigate them?

- What opportunities does sustainability present for the organization to develop new products or services?

- Which sustainability issues should we prioritise, and do we understand how to implement changes which will deliver improvement?

- What investment is needed to enable the company to meet its sustainability reporting requirements, future-proof the business from sustainability-related risks and to capitalize on the opportunities?

- What targets should be set to stimulate progress, and which metrics need to be developed to measure performance?

- Is our current data gathering system able to cope with new sustainability reporting requirements? Do we collect the sustainability data we need and have sufficient digital systems across the organization to process this data?

- Are the organization’s non-financial data flows, controls, and documentation ready for reporting externally and for assurance?

Navigating this landscape and operationalizing sustainability disclosures is a complex task requiring a programmatic approach and corporate-wide management with clear roles and responsibilities. As companies can be organized differently, approaches to sustainability can differ. However, to move beyond disclosure towards sustainability integration across an organization, there are three primary components that a company should consider: people, process and technology.

- People engagement is important to help a company understand all individuals impacted by the implementation of sustainability standards and frameworks.

- Processes will undoubtedly change with a company’s approach to sustainability, and any gaps that may hinder a company’s compliance process should be identified.

- Upon disclosure, companies should utilize digital resources to ensure their disclosures are accurate, consistent and easily accessible.

Sustainability is now part of core business. The importance of sustainability issues, such as those related to climate change, will only increase as more companies globally are mandated to report on their risks, opportunities and performance, due to intensifying scrutiny from a wide range of concerned stakeholders. As a result, CFOs need to take responsibility for helping ensure their organizations are able to report robust sustainability data.

The significant cost implications and opportunities of transitioning to more sustainable and net zero businesses place sustainability firmly on the CFO’s agenda in terms of understanding the financial risks and opportunities to their organization. Thinking through how their organization can achieve these longer-term commitments without compromising short-term financial performance is a key issue CFOs need to consider.

CFOs will need to understand how leading on material sustainability topics can help their company gain and maintain a competitive advantage and drive performance improvement. The rapid growth and diversification of new sustainable financial instruments such as green and blue bonds mean that CFOs also need to understand this evolving landscape and the potential opportunities for their organizations to access new sources of finance.

Author contacts

Richard Betts, Consulting Partner EMEA

Richard.Betts@erm.com

Onur Durmus, Regional Service Leader for Sustainable Operations EMEA

Onur.Durmus@erm.com

Beth Wyke, Partner Corporate Assurance CVS

Beth.Wyke@ermcvs.com