New research from The Renewables Consulting Group, an ERM Group company, finds that global offshore wind market development soared during 2022 due to energy vulnerability across several key European markets.

According to RCG’s Annual Market Report for Global Offshore Wind, the Russian invasion of Ukraine in February 2022 forced many European nations to rethink their dependence on imported fuels and many turned to offshore wind as a sound mitigating strategy. For example, Germany - due to its heavy pre-war reliance on Russian natural gas - doubled down on its already strong support for offshore wind by adding 36 GW of capacity to its tender schedule.

In total, more than 550 GW of offshore wind capacity was added to the global development pipeline in the Americas, Sweden, Australia and China. At the end of 2022, the total for global offshore wind stood at 1,250 GW.

Breanne Gellatly, ERM Partner and Global Service Lead for Strategy and Markets, said: “The Russian invasion of Ukraine reminded every nation of the importance of energy independence and sustainability, and this resulted in increased offshore wind targets and pipelines during 2022. As countries continue to further develop their offshore wind frameworks, backed by accelerated renewables targets due to global energy security concerns, the global offshore wind industry is expected to continue to grow at an accelerated rate and expand into new territories.”

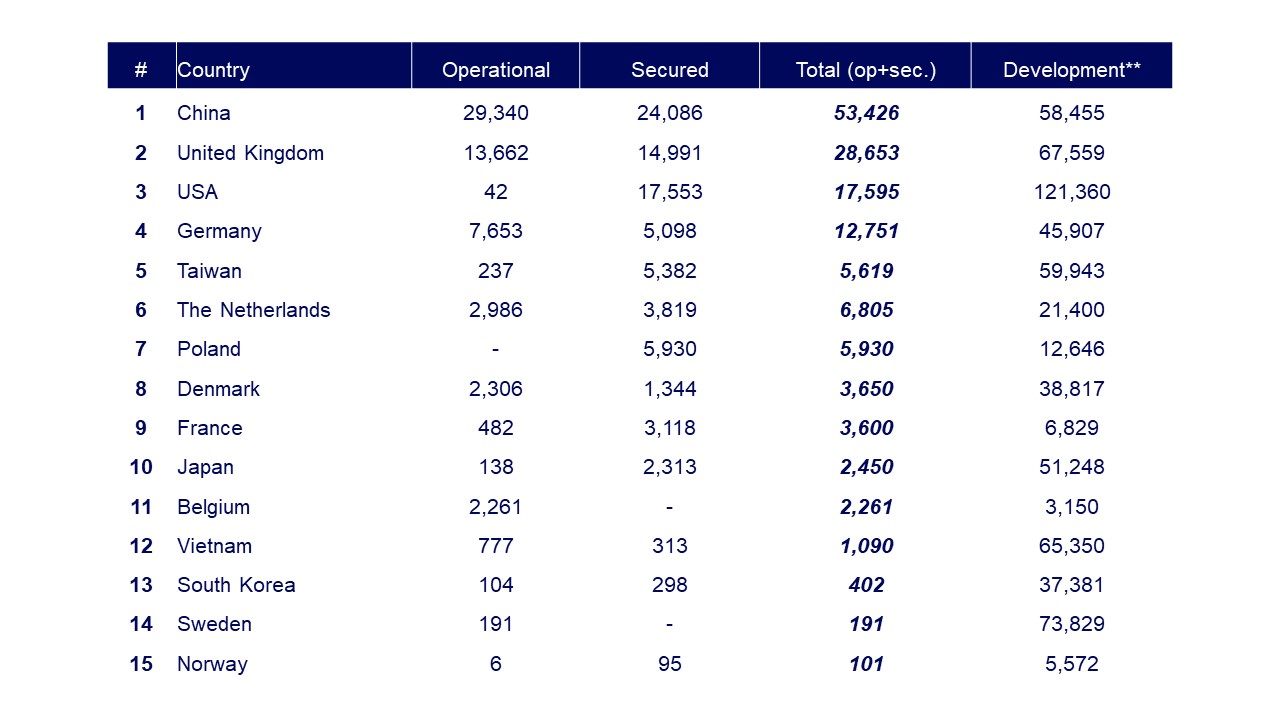

The report demonstrates that the countries which have proven seabed lease auctions and tender frameworks in place drive the market. In fact, four countries (China, UK, US and Germany) comprised 75% of the 145 GW of projects that were in operation or secured offtake power contracts during 2022. Throughout 2022, the UK and US awarded leases to sites with a combined capacity of 24.8 and 18.4 GW, respectively. Commissioning activity in China continued at a moderate rate, despite the expiry of the national subsidies in 2021.

Top 15 countries, operational + route to market secured, MW*

| Source: Global Renewable Infrastructure Projects (GRIP) database. |

| *Ranking based on total route to market secured and operational capacity. |

| **Development capacity is additional early stage development projects. Since projects are in varying levels of development, and some have overlapping areas, this can lead in some cases to overly high MW data estimations. |

| Charts show fixed+floating offshore wind capacity. |

RCG attributes the global gains to three primary market drivers: auctions, inroads to floating wind technology and expansion into new markets.

Offshore wind auctions occurred across nine markets within EMEA, APAC, and the Americas throughout 2022. Some are for project sites, power contracts and in many cases both. In total, up to 80 GW of capacity was launched for auction through leasing rounds and subsidy tenders. Both mature and newer markets allocated capacity throughout the year. ScotWind awarded leases to 24.8 GW of capacity while Finland launched offshore wind tenders for the first time.

Floating wind technology

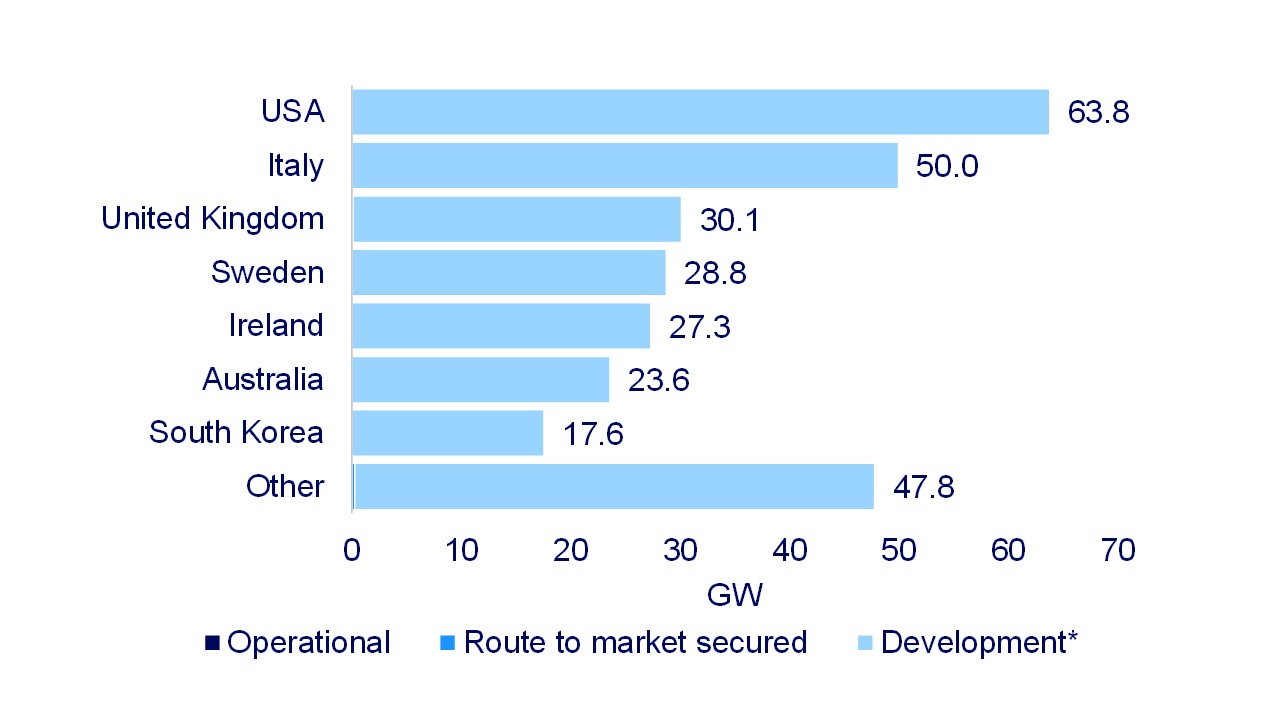

While fixed-bottom offshore wind still dominates the market, the report finds that floating offshore wind development capacity doubled throughout the year. In fact, floating offshore wind now exceeds 20% of the global portfolio total with UK, Norway and France emerging as market leaders.

Over 170 GW of capacity was added to the global floating offshore wind development portfolio throughout 2022. New floating projects were announced in 15 markets. Floating projects were announced for the first time in New Zealand (3,149 MW), the Philippines (3,100 MW) and Denmark (2,976 MW).

More than 80 GW of capacity was announced in EMEA, further securing the region’s position as the global leader for floating capacity. Notably, significant increases in floating early-stage development capacity were seen in Italy and Ireland.

Increases in the Americas region were attributable to the US, where more than 60 GW of floating capacity was announced. Recent leasing rounds along the Central Atlantic, California, Gulf of Mexico and Oregon promise to open vast new areas for floating wind.

Some emerging markets, such as Costa Rica, Egypt and Turkey have initiated the process of developing offshore wind policy.

In 2022, the Costa Rican Electricity Institute (ICE) announced studies to identify offshore wind potential in the country. The studies are also to explore the challenges, risks, and opportunities in the development, installation, and operation of offshore wind farms. The studies are expected to take place over an 18-month period.

Two offshore wind projects in Egypt were proposed in Q4 2022, and if developed would be the first projects in the country.

A look ahead

For the remainder of 2023, offshore wind auction activity is expected to increase significantly, with numerous countries, such as Spain, Portugal, Lithuania, Norway and India intending to hold their first offshore wind auctions.

Both Brazil and Colombia want to advance an auction system in late 2023. However, exact details are still being finalized. Brazil especially has seen a rapid increase in early-stage development. Development will remain in early-stages until policies are in place to lease the seabed and encourage development with power purchase tenders or other procurement incentives.

Likewise, Canada is awaiting policy and support to catch up with ambitions. Nova Scotia in 2022 showed notable first steps as it became the first and only province setting out offshore wind ambitions with a target for 5 GW. Tenders for project sites and capacity are targeted for first awards in 2025.

Generally speaking, the report notes that the lack of leasing and route to market frameworks in countries with early stages of development, such as Brazil, Spain and Sweden, will limit near-term growth of offshore wind deployment in these markets.

As supply chain capacities for offshore wind were already in question before the war, the report's authors caution to expect some disruption in supply chain capacity. Supply capacity can be a massive bottleneck to delivering ambitious targets.

A full analysis and forecasts can be viewed in ERM’s Global Offshore Wind: Annual Market Report. The 168-page summary includes details on each offshore wind market with analysis of the resources that will allow projects to reach route to market, financial close, and commissioning milestones. An overview of the global supply chain is also provided. To purchase a copy of the Annual Market Report, or to sign up for a free trial of the offshore wind GRIP database, visit thinkrcg.com/data-services/.

About The Renewables Consulting Group, an ERM Company

The Renewables Consulting Group, an ERM Group company, is a specialized expert services firm supporting the global renewable energy sector. From strategy to implementation, the company serves businesses, governments, and non-profits around the world with technical and management consulting services for both mainstream and emerging renewable energy technologies. RCG works with the public sector, private equity and financial services firms, utilities and project developers, equipment manufacturers, and engineering and construction companies for on- and off-shore wind, solar, and emerging technologies including wave and tidal and energy-storage projects. RCG is headquartered in London, and has offices in New York, Tokyo and elsewhere. For more information, visit our website at www.thinkrcg.com or connect with us on Twitter via @thinkrcg.

View all

View all