Value creation from corporate and investor Net Zero strategies in the coming years will move beyond own operations to focus on Scope 3 emissions. For many business leaders, the period from 2025 to 2029 will mark the first time that reporting on their value chain, or Scope 3, greenhouse gas (GHG) emissions becomes part of their mainstream disclosures, since new regulations, including the EU Corporate Sustainability Reporting Directive (CSRD), and the FCA’s Sustainability Disclosure Requirements in the UK are bringing mandatory requirements to companies’ doorstep.

Scope 3, or value chain, greenhouse gas emissions data is becoming a new source of value creation and business intelligence for companies and their stakeholders, driven by emerging transparency requirements, digital solutions, product and service innovation, and supplier engagement. This is the second of two articles on Scope 3 emissions disclosure and performance. Please click here for the first article, ‘Unlocking business value from Scope 3 emissions reporting’.

Moving from voluntary to prescriptive Scope 3 disclosure

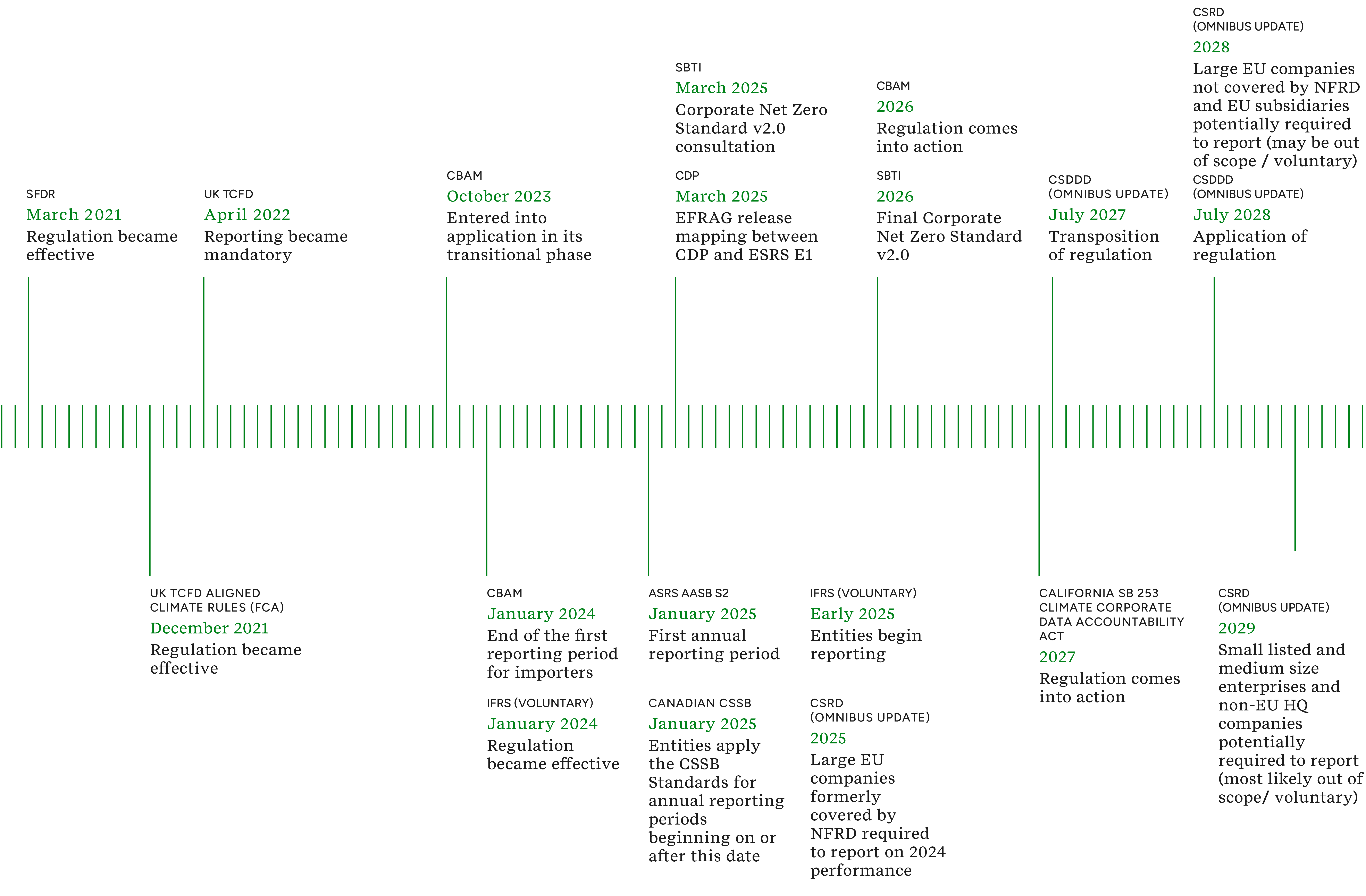

Many leading companies have already done some Scope 3 emissions reporting, disclosing their supply chain emissions under voluntary schemes such as CDP, the Task Force on Climate-Related Financial Disclosures (TCFD) recommendations, and the Science-Based Targets initiative (SBTi) for several years. However, the completeness and quality of these voluntary Scope 3 disclosures have been highly variable.

With Scope 3 reporting requirements becoming mandatory in various jurisdictions over the next few years, notably under the UK Financial Conduct Authority (FCA) rules and the European Union’s Corporate Sustainability Reporting Directive (CSRD), the bar is being raised. In the U.S., while companies do not face requirements at the federal level, some states, such as California, also require large businesses to disclose Scope 3 emissions or are considering such bills. Countries in Asia Pacific, including Australia, China, Hong Kong, and Malaysia, will require Scope 3 disclosure, while the UAE and Turkey have enacted Scope 3 requirements. The Johannesberg Stock Exchange, along with Nigeria is eyeing mandatory sustainability disclosure by 2028, including Scope 3 emissions, while in Latin America, Brazil has enacted Scope 3 disclosure requirements.

The mandatory disclosure requirements are substantially more prescriptive regarding completeness, materiality, risk, and opportunity assessments for Scope 3, as well as the categories companies need to report on.

EU Omnibus changes CSRD compliance timeline

| In the case of CSRD, the EU Omnibus proposal, which aims to simplify EU sustainability disclosure regulations, and mandates reporting on Scope 3 emissions among other topics, has postponed the start of CSRD compliance for many companies. While the EU Omnibus is undergoing EU approval, the original timelines for wave 2 entities (large EU companies) and wave 3 entities (large third-country subsidiaries and listed SMEs) have been revised. These entities will now be required to comply in 2028 and 2029, respectively, instead of 2026 and 2027. Since approval of the EU Omnibus proposal would also substantially reduce entities in scope, other companies, such as listed SMEs, would not be required to comply at all, although many may choose to do so voluntarily. For wave 1 companies (large companies that are also public interest entities), already reporting under the Non-Financial Reporting Directive (NFRD), compliance with CSRD will still start in 2025, as originally planned. For more details, see ERM's EU Policy Alert. |

Some of the major standards covering Scope 3 disclosures are summarized in Figure 1, including new climate regulations such as the EU Carbon Border Adjustment Mechanism (CBAM), which will require the pricing of embedded carbon in select products and services. Reporting and rating schemes that investors use to benchmark company emissions and make decisions on perceived Scope 3 risks and opportunities, such as CDP and MSCI, are also detailed.

Figure 1: Scope 3 disclosure requirements under leading ESG standards and regulatory frameworks

Download Scope 3 disclosure requirements in detail

As Scope 3 disclosure becomes mandatory for many companies, stakeholder pressure on companies to align their decarbonization strategies with relevant net-zero targets and produce credible climate transition plans is building simultaneously. Under the SBTi guidance for most sectors, which CSRD refers to, this would require absolute emissions reduction across the value chain of up to 42 percent by 2030 and a 90 percent reduction by 2050 (compared to 2020 levels). Such steep reductions will demand major changes in how companies approach procurement, working with key suppliers, and product and service design.

Leveraging Scope 3 materiality to unlock value

Companies shouldn’t see mandatory Scope 3 disclosure as just another compliance burden, but as a new opportunity to create value or avoid value destruction. Supplier selection processes are also starting to add new criteria for Scope 3 reporting and targets. Some businesses are also contractually requiring their key suppliers to provide product footprint data, and in the UK government contracts also require Scope 3 assessment under standard PPN 06/21.

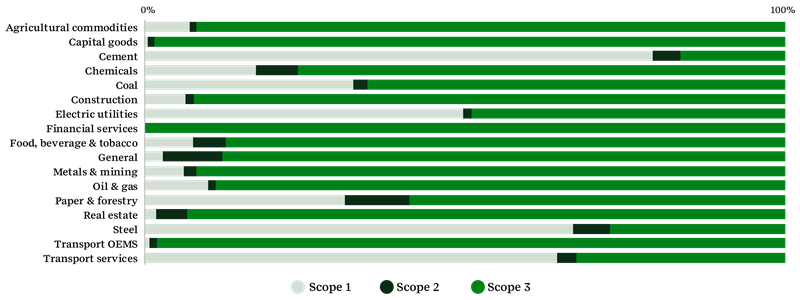

As organizations begin to calculate their value chain emissions in line with the GHG Protocol and new disclosure requirements, many are discovering that the Scope 3 emissions across their value chain (services, products, or assets) are five to 20 times higher than their operational Scopes 1 and 2 emissions (see Figure 2 below). Carbon costs, risks, and opportunities are also proportionally higher for Scope 3 emissions in many sectors, presenting new challenges and opportunities to create business value from decarbonization.

Figure 2: Scope 3 emissions for CDP high-impact sectors

Source: CDP data (using Scope 3 categories defined by the CDP Activity Classification System)

Identifying material issues will be key to implementing a Scope 3 data processes, emissions reporting and performance strategy that meets disclosure requirements and unlocks business value.

Steps to identify material Scope 3 emissions include:

1. Mapping Scope 3 emissions hotspots across your value chain

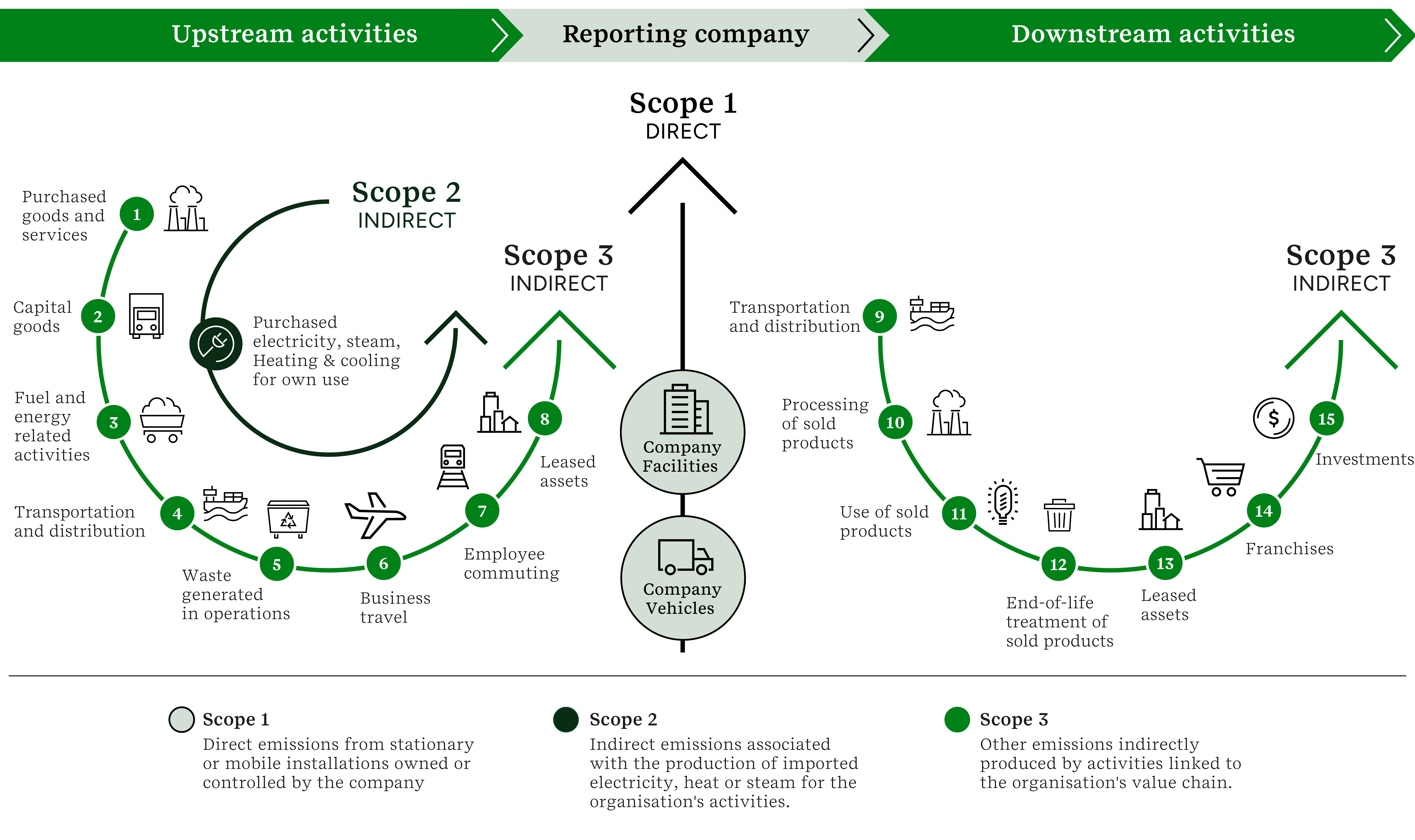

Start mapping out emissions hotspots (sources of most substantial emissions) throughout the company value chain, across the 15 upstream and downstream Scope 3 categories identified by the GHG Protocol (outlined in Figure 3).

Figure 3: 15 value chain categories within scope 3 emissions

Source: GHG Protocol Corporate Standard

Whenever a cash flow, purchase, product or service sale, or investment is reported, an equivalent carbon figure (in tonnes CO2 equivalent), calculated using either activity data (quantity or spend) combined with appropriate emissions factors, or actual emissions data, should be reported as well. In this way, Scope 3 emissions can be a highly valuable proxy for costs in the supply chain and help identify opportunities for efficiencies and cost reduction. This task will often require inputs from finance and procurement teams, as well as experts with GHG assessment skills and access to the relevant emissions factor databases to quantify the CO2 emissions.

To enable efficient and comprehensive reporting, companies will need to invest in new climate data reporting platforms to handle the diverse types and volumes of Scope 3 activity data and emissions factors required, as well as track progress on supplier engagement. Investments in climate data technology can also enable GHG data to be mined for creating business value.

2. Understanding your Scope 3 reporting requirements

The focus of a company’s Scope 3 reporting strategy will depend on which disclosure requirements apply, for example, IFRS for listed companies and the finance sector, CSRD for companies with a large EU presence, CBAM for product imports to the EU, or SBTi-aligned reporting for asset managers. It will also be driven by investor and customer demands.

Companies will need to mitigate the risk that incomplete reporting of Scope 3 emissions could lead to claims of greenwashing, as highlighted in some recent high-profile EU legal cases and advertising regulator rulings. Examples include focusing on just business travel and employee commuting, while the negative impacts of purchased goods and services, or customer use of sold products or assets, are the largest emission source by far.

In the UK, reporting of Scope 3 emissions and a net-zero plan is now a formal requirement when bidding for certain government contracts. ERM also observes that Scope 3 risk and opportunity are being more frequently raised in due diligence reviews, with lenders and private investors increasingly challenging companies on this during the transaction process.

Company management functions that need to lead and implement the Scope 3 strategy are often not familiar with the complexities of value chain GHG reporting. Executives will need to be fully briefed and prepared to steer and sign off on the Scope 3 strategy and disclosures. Larger companies will also need to develop Scope 3 governance, audit and assurance processes.

3. Making business sense of Scope 3 data

Companies should treat Scope 3 data as valuable business intelligence, alongside meeting mandatory and voluntary disclosure requirements and aligning with investor and customer demands.

Business potential will be unlocked by prioritizing high-quality assurance-ready data, investing in expertise and analytical capabilities, and integrating Scope 3 targets into decision-making processes. Direct engagement with suppliers is also required to understand supplier incentives and barriers and improve Scope 3 data and performance.

Many companies have started to make progress in understanding their Scope 3 hotspots and decarbonization risks and opportunities at the product, service, or asset level. More advanced companies have set science-aligned targets for supply chain emissions for 2030 and beyond, with quantified value creation and business resilience plans closely tied to them. As Scope 3 disclosure matures across the value chain, the opportunities to integrate value chain emissions into company business strategies are set to increase, allowing businesses to realise the full value from leveraging this carbon intelligence data.