Global electric vehicle (EV) sales are rising rapidly, with 10.5 million new battery and plug-in hybrid EVs delivered in 2022, an increase of more than 50 percent compared to 2021. Demand from consumers continues, driven by improving charging infrastructure, increasing EV product choices, and the rising cost of gas. EVs also play a significant part in government climate strategies - the US government aims for 50 percent of all new vehicles sold to be electric by 2030, and the European Commission plans for at least 30 million zero-emissions cars to be on the road by 2030.

However, EV manufacturers are struggling to meet such high demand due to a combination of the global energy crisis, unstable supply chains, and prominent sustainability challenges with the sourcing of raw materials.

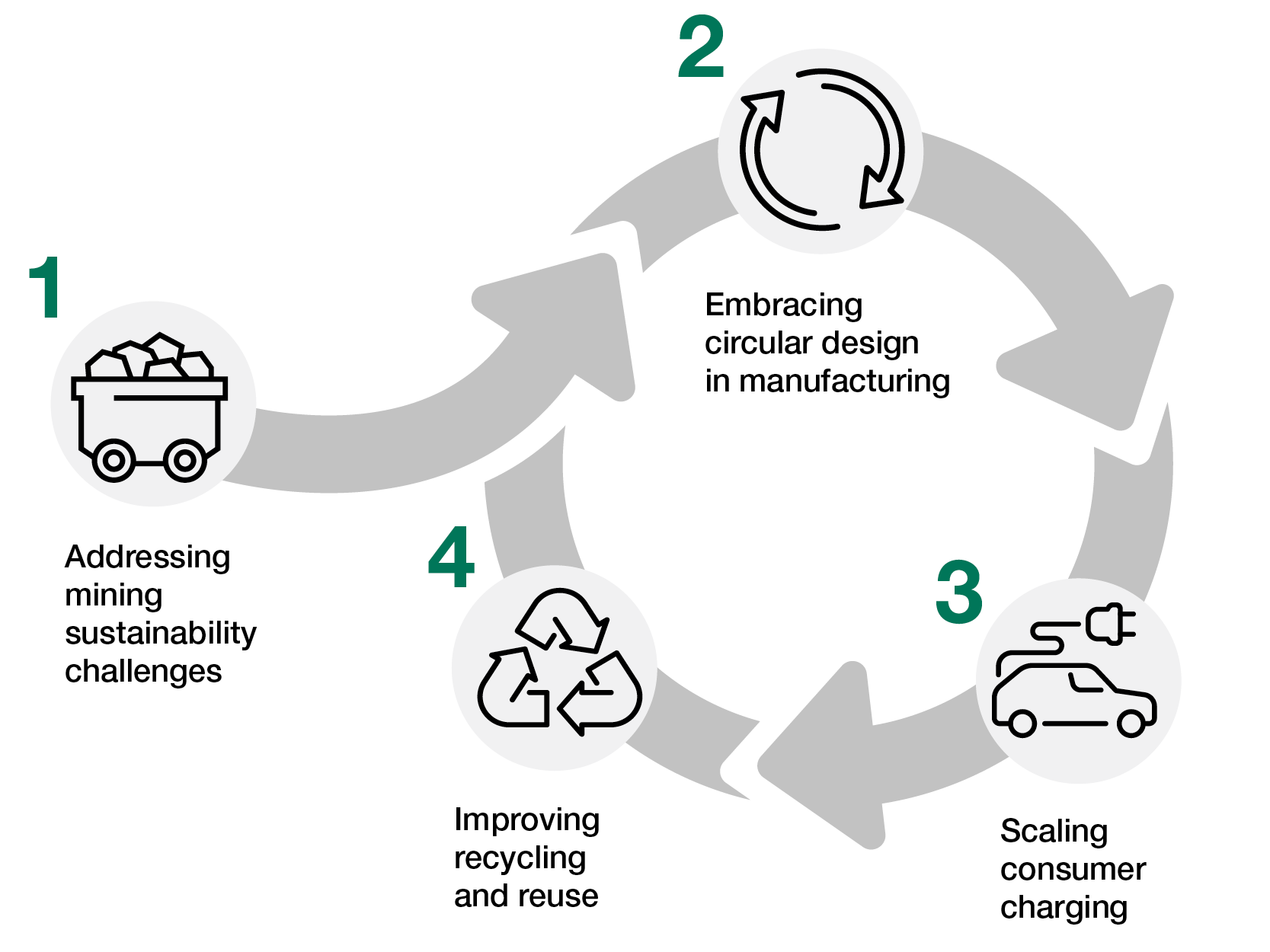

ERM recently convened a roundtable series with senior executives from companies in the EV value chain to discuss scalability and sustainability across suppliers, manufacturing, charging infrastructure and end of use recycling. Participants agreed that a holistic and circular strategy is needed to support rapid EV deployment and infrastructure across four key imperatives:

1. Addressing mining sustainability challenges

As EV demand grows, so too are the issues facing the industry. Supply chain instability and sustainable sourcing struggles have made it difficult for EV manufacturers to keep up. As the world gears up to replace two billion gas-powered vehicles with electric alternatives in the race to net zero, responsible sourcing of lithium and other critical minerals will become vital to support the exponential rise in EV battery production.

A sustainability imperative for mining operations, which allows them to maintain their social licence to operate, is to not only avoid negative impacts to local communities, but to also bring benefits. George Thomas, Head of Global Communications and Corporate Citizenship at lithium producer Livent, shared his own perspectives on the need for a people-first approach: “‘In the lithium triangle in Argentina, right at the Salar del Hombre Muerto. It's at four thousand meters. It's a very desolate part of the world... There are only about 40 or 50 people in a 60-kilometer area where we have our operation, so it's very hard to get to. But those people matter, and so do the villages and towns further away down the mountain, so we have to put them at the heart of our strategy”.

To help address the imperative of socially responsible mining practices, conducting supply chain lifecycle assessments can show the true environmental and social impacts of resulting products.

Good stewardship and environmental practices promoted by sector consortia, such as the Responsible Business Alliance, Responsible Minerals Initiative, The Initiative for Responsible Mining Assurance and leading industry associations such as the Mining Association of Canada and the International Council on Mining and Metals, can enable effective stakeholder collaboration, environmental protection, social performance and good governance. Effective sustainability management can also lead to improved efficiencies in the supply chain. This includes measures such as ensuring lithium hydroxide is ISO compliant and third-party verified and that miners are operating within generally accepted industry guidelines, such as from the OECD.

The First Nations Major Projects Coalition in Canada, a collective group of Indigenous First Nations, has created a vision that clearly outlines the essential role of Indigenous self-determination and economic reconciliation in enabling the development of critical minerals and supporting the net zero transition. This model for Indigenous participation has measurable commitments to economic benefit sharing and could set a benchmark for mining on Indigenous lands.

Todd Malan, Chief External Affairs Officer and Head of Climate Strategy at Talon Metals suggested that “working in partnership with local communities may help EV manufacturers with their brand franchise - as they talk about their responsible sourcing, they can have not just a standard but a story to it.”

2. Embracing circular design in manufacturing

EV manufacturers should design a circular ecosystem and operationalize sustainability to deal with factory issues such as recycling, Environmental Health & Safety (EH&S), energy and waste management. Roundtable participants offered several examples of how best to do this, starting with looking at the data and building approaches accordingly. Andrew Wehr, Vice President of EHS at EV manufacturer Rivian, talked of the need to “look at the macro data to see how you can aggregate waste processes into a single, or maybe a smaller group of vendors.”

Building on this starting point, participants gave the following examples:

3. Scaling consumer charging

3. Scaling consumer charging

The pace of charger installation is already high. But while progress has been made, there is still some way to go before we reach a critical mass of charger infrastructure. For example, according to Andreas Lips, CEO of Shell Recharge Solutions, “Globally, Shell aims to expand its EV charging offer to operate more than 500,000 charge points by 2025 and 2,500,000 charge points by 2030.”

Utilities in Northern and Central California have assessed that today one percent of peak electricity load currently comes from EV charging—by 2040, that is anticipated to grow to 30-40 percent. There are many challenges and opportunities in scaling charging to meet this anticipated growth, requiring collaboration with multiple stakeholders, including utilities, governments, private consortia, energy companies and EV manufacturers.

Roundtable participants identified a number of recommendations for scaling consumer charging, including:

4. Improving recycling and reuse

At the end of a vehicle’s usability, the EV industry needs to maintain a continuity of supply by harvesting and reintroducing as much material as possible back into the EV manufacturing process, as well as recycling and reusing waste.

Alan Ferguson, Commercial VP Americas at recycling company Li-Cycle, shared that “we are creating leading edge factories capable of taking a lithium battery and returning it back into the supply chain within months of receipt”, demonstrating the existing potential to recycle and reuse critical inputs more effectively.

Participants also suggested using a variety of recycling initiatives, including:

- Establishing partnerships with EV dealers and distributors to create an intentional return scheme designed to reclaim as much material as possible and send it to the appropriate recyclers.

- Working with municipalities, private junkyards, and scrap dealers to return as many materials and end-of-life EVs as possible, including lithium-ion batteries from other sources, such as yard tools and computers.

- Repurposing certain grades of recycled lithium, which could include re-entry into the consumer market (hand tool manufacturers, PCs) and large-scale backup storage for utility providers.

Creating an ecosystem of change

The EV industry is disrupting traditional transportation and technology business models, just as the iPhone did for personal electronics and the cell phone market in 2007.

Governments worldwide are creating incentives for EV adoption that increase demand for vehicles (and their key components). Manufacturers are blazing a trail through self-regulation and energy companies are pivoting their business models to satisfy demand for charging infrastructure and shore up the grid. The cascading demand on renewable energy companies is also acute as consumers demand a sustainable system to power their EVs.

In the challenges come growth and opportunity. There is clearly recognition among EV industry executives that existing progress related to the circularity and recyclability of the components involved (especially lithium) must be accelerated. Such is the complexity of the EV value chain that only by an ecosystem-wide effort will the industry keep EVs on the road and their components out of landfills.

ERM wishes to thank the EV industry roundtable series participants who contributed their insights to this article.