Two recent developments give companies a clearer view of what the final shape of the landmark EU Omnibus proposal may look like. Earlier this year, the EU Omnibus and ‘stop-the-clock’ proposals outlined changes by the European Commission to reduce the reporting burden of the Corporate Sustainability Reporting Directive (CSRD), the EU Taxonomy, and the Corporate Sustainability Due Diligence Directive (CSDDD). Read more on these proposals here.

While the ‘stop-the-clock’ proposal (approved in April) delays the timeline for when companies need to report by two years, the Omnibus package (released in February) is committed to reducing and simplifying the actual scope of what companies need to report. However, many details of how this simplification will take shape remained unclear. Two events in July give the clearest indication yet of the scope of the reduction of companies’ reporting burden.

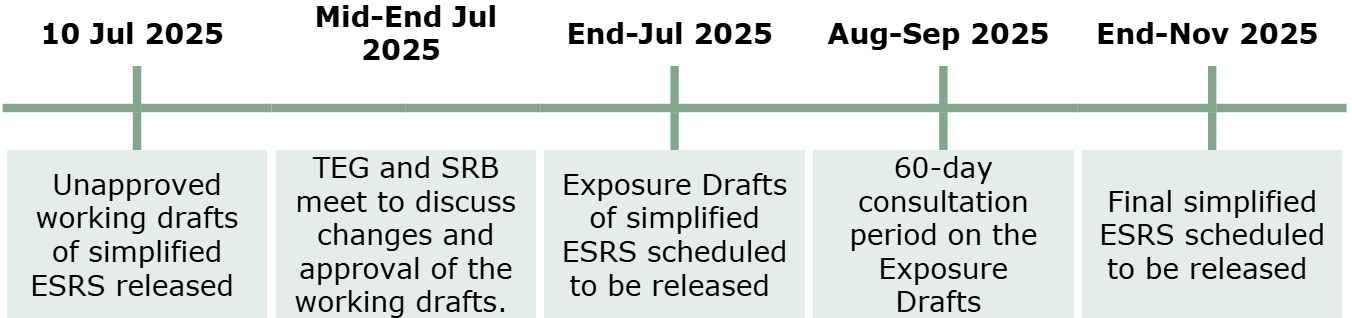

- On July 10th, the European Financial Reporting Advisory Group (EFRAG), which is responsible for developing the European Sustainability Reporting Standards (ESRS), released unapproved ESRS Amendments Exposure Drafts. The ESRS provides detailed guidance on how companies must fulfill their CSRD reporting obligations. EFRAG is in the process of simplifying the standards and aims to publish approved Exposure Drafts by the end of July. However, these working documents received approval in principle during the EFRAG working meetings, indicating that the exposure drafts will be broadly aligned.

- On July 4th, the European Commission adopted a set of measures to simplify the application of the EU Taxonomy, a classification system that defines which economic activities and investments are considered environmentally sustainable. The EU Taxonomy and ESRS are closely connected, as the ESRS requires companies to disclose information on how their activities align with the EU Taxonomy.

This blog explores what companies can learn from these new developments, outlines the main proposed changes that companies should be aware of, and, if approved, when these changes are expected to be implemented. The first part of the blog will cover the ongoing ESRS simplification process, while the second part will delve into the most recent changes to the EU Taxonomy.

ESRS: What are the main changes in the simplified working drafts?

The working drafts offer a first peek at what the simplified ESRS may look like. The drafts, which include working documents of each revised standard and an explanatory cover note (see the ‘Meeting Documents’ section), formed the basis for discussions at meetings of the Technical Expert Group (TEG) and Sustainability Reporting Board (SRB) (meeting recordings are also available on the EFRAG website).

As such, these working documents are subject to change following the TEG and SRB meetings and should not be considered final Exposure Drafts. Still, the unapproved drafts received broad support and provide early insight into EFRAG’s position and the direction the reporting requirements are heading.

The simplification effort EFRAG envisions is driven by six key levers:

Table 1: Six levers of simplification

Among the most notable changes is the reduction in the number of required data points. EFRAG aims to eliminate all mandatory data points not strictly necessary to meet disclosure objectives. The unapproved working drafts indicate EFRAG plans to reduce the overall number of ESRS data points by approximately 66 percent, exceeding the initial aim of a 50 percent reduction, as stated in EFRAG’s ESRS simplification progress report (released June 20th). This includes the reduction of mandatory “shall” data points (by over 50 percent) and the removal of all 277 voluntary “may” data points (by 100 percent). These data points have either been fully deleted or moved to non-mandatory items or separate guidance documents.

Below is a detailed overview of the pertinent changes included in the unapproved ESRS Exposure Drafts.

On materiality:

- Top-down approach: The working drafts provide more flexibility in determining key material topics, allowing companies to predetermine the most obvious issues based on an analysis of the market and business model. This is intended to reduce complexity and unnecessary scoring of individual impacts, risks, and opportunities (IROs).

- Information materiality: There is an overarching filter for the inclusion of information in the sustainability statement, based on the hierarchy of information materiality. The “significance” of information criterion has also been clarified and is connected to usability and the needs of users. Non-material information may be disclosed where relevant for other users, like rating agencies, etc.

- Fair presentation: There is greater emphasis on the objective of fair presentation to reduce the risk of over-reporting.

- Gross vs. net issue: New guidance is provided on how to consider the implemented remediation, mitigation, and prevention policies and actions when assessing the materiality of an impact.

On disclosure requirements:

- MDRs and PATs: minimum disclosure requirements (MDRs) and policies, actions, and targets (PATs) within topical standards are drastically reduced.

- Metrics and data estimation: The relief of “undue cost and effort” is extended to all metrics, including metrics within company’s own operations. Non-material activities are excluded from metric calculations. The proposal also removes the requirement to first attempt to collect primary data from the value chain before using estimates. Instead, companies can rely more readily on estimates based on secondary data (e.g., industry averages).

- Financial quantification: EFRAG is considering two options for financial quantification disclosure requirements. One is to require reporting qualitative instead of quantitative information only when the level of estimation uncertainty is so high that the resulting quantitative information would not be useful. The second option is to only require qualitative information and leave the option to the undertaking to disclose quantitative information. Information on investments and plans will be limited to those that have already been announced.

- Resilience: Limited information on resilience to qualitative information and only for risks (not impacts or opportunities).

On the preparation and structure of sustainability statements:

- Flexibility on material IRO vs topical reporting: Across all disclosures, flexibility is provided to the undertaking to decide whether to report at the IRO- or topic-level, based on the nature of the IROs and reflecting the managerial approach to them. The term “matter” is replaced by “topic,” which can refer to a “topic” or a “subtopic”, depending on the level required to meet a disclosure objective. When only a sub-topic is material, the undertaking must limit the information reported within a topical standard to that sub-topic. To help undertakings understand the correlation between individual disclosures and specific subtopics, a non-mandatory appendix will be published.

- Sub-topic and sub-sub-topic changes: Sub-sub-topics have been removed; this is part of the streamlining of the list of sustainability matters in ESRS 1 application requirement 16.

- Reporting boundaries: The perimeter of consolidated financial statements has been clarified as the starting point, but additional guidance on the treatment of specific transactions is provided.

- Executive summaries & appendices: Options are provided for an “executive summary” at the beginning of the sustainability statement. There are also options to disclose granular information, for example, detailed metrics, in dedicated sections or appendices.

- Reduction in duplicative content: PATs only need to be described once (even if covering multiple subtopics), and PATs can be limited to a specific subtopic without triggering disclosure at the topic level.

On the presentation of the ESRS standards:

- Streamlined requirements: All mandatory “shall” data points have been simplified and counted as separate data points. All voluntary “may” data points have been eliminated or moved to separate guidance documents.

- Separate mandatory and non-mandatory content: Application requirements have been placed directly under the related disclosure requirement. All non-mandatory content has been moved to separate documents named “Non-Mandatory Illustrative Guidance” (NMIG).

When can we expect a final version of the simplified ESRS?

Again, the working drafts of the simplified ESRS are currently unapproved and subject to change. Following approval (expected end-July), a 60-day consultation period will open. The final version of the simplified ESRS is expected to be released at the end of November.

CHART 1: Simplified ESRS Publication Timeline:

EU Taxonomy: What are the main changes to the EU Taxonomy delegated regulation?

A week before EFRAG dropped its unapproved ESRS Exposure Drafts, the European Commission adopted a set of measures to simplify the application of the EU Taxonomy, amending the existing EU Taxonomy Delegated Acts. The European Parliament and Council will now examine the updated Delegated Acts during a four-month period, which can be extended by two months. However, it is unlikely this review process will lead to major modifications.

The simplified rules will take effect on January 1, 2026. Companies must apply the new rules from that date (i.e., for 2025 data). However, they can choose to delay the application of the new rules by one year.

Below is an overview of the key changes adopted by the European Commission.

TABLE 2: Key adopted changes in EU Taxonomy

What should companies be doing now?

Companies in scope of CSRD should continue to monitor progress on the EU Omnibus and the simplified ESRS. Once the Exposure Drafts of the simplified ESRS are released at the end of July, there will be an opportunity to provide feedback via the 60-day public consultation period.

As part of the “quick-fix” amendments, the European Commission adopted on July 11th, Wave 1 companies that have already reported on fiscal year 2024 will not have to report additional information in financial years 2025 and 2026. In instances where Wave 1 companies have already exceeded disclosures that will likely be required by the simplified ESRS, or have existing data that would enable them to do so, they should carefully weigh the pros and cons of maintaining disclosures beyond what is demanded.

Regarding the new EU Taxonomy measures, which are expected to take effect in early 2026, companies have the option to postpone implementing the new rules by one year. Since the new EU Taxonomy requirements will be less burdensome than the current ones, companies should seriously consider whether a delay makes sense for them.

Regardless of which CSRD implementation wave applies, companies should focus on no-regret actions. Understanding the financial effect of risks enables businesses to methodically identify and quantify a commercial business case for sustainability. Be ready to review double materiality through a top-down approach. Invest in financial quantification capabilities that can help prepare for post-EU Omnibus reporting as well as for reporting in accordance with international reporting frameworks such as the ISSB.

How can companies stay informed?

ERM will continue to closely track further regulatory developments and provide detailed interpretation of the ESRS Exposure Drafts once published, as well as other updates related to the EU Taxonomy. For more information on the EU Omnibus, read our earlier update, our policy alert here, or reach out to our experts.