Low-carbon hydrogen stands to become an essential element of the net zero transition for oil and gas. By scaling up clean hydrogen production, oil and gas companies have the opportunity to both decarbonize their direct operations and become key suppliers of low-carbon fuel to a wide range of industries, helping multiple industries to meet their own net zero targets. These include harder-to-abate sectors, such as steel manufacturing, fertilizer production and maritime, aviation and heavy vehicles transport.

The oil & gas sector is the world’s largest consumer of hydrogen, with oil refineries using approximately half of global hydrogen consumption in chemical processes, such as lowering the sulfur content of fuel.

As policies mature and clean hydrogen markets emerge, oil and gas companies are looking to invest in clean hydrogen production, with significant growth ahead, as 93% of all low-carbon hydrogen investments are pending final investment decision. Subsidies for low-carbon hydrogen have quadrupled over the last two years to more than $280 billion, and opportunities are opening up for the oil & gas industry to scale clean hydrogen at pace.

What are the key policy developments that oil & gas companies need to understand as they look to establish a long-term roadmap for transitioning to clean hydrogen?

Levers to scale up the clean hydrogen market

While several countries have created supply-side policies designed to support clean hydrogen production and infrastructure, as a nascent market, hydrogen requires holistic support, including strong demand-side policies to encourage early adopters and help to scale the market. Key market barriers to overcome include:

- Higher production costs. Producing low-carbon hydrogen currently incurs much higher Capex and Opex costs compared to hydrogen derived from unabated fossil fuels.

- Uncertainty around future demand. This stems from multiple market factors, such as the pace of adoption of hydrogen technologies and infrastructure in different sectors, the ability to pass green premiums down the value chain and for end-users to absorb higher costs.

- Regulatory and certification challenges. The regulatory framework surrounding hydrogen production, distribution and use is often unclear or incomplete. In addition, a lack of standardized certification processes for low-emission hydrogen is hindering its acceptance in the market.

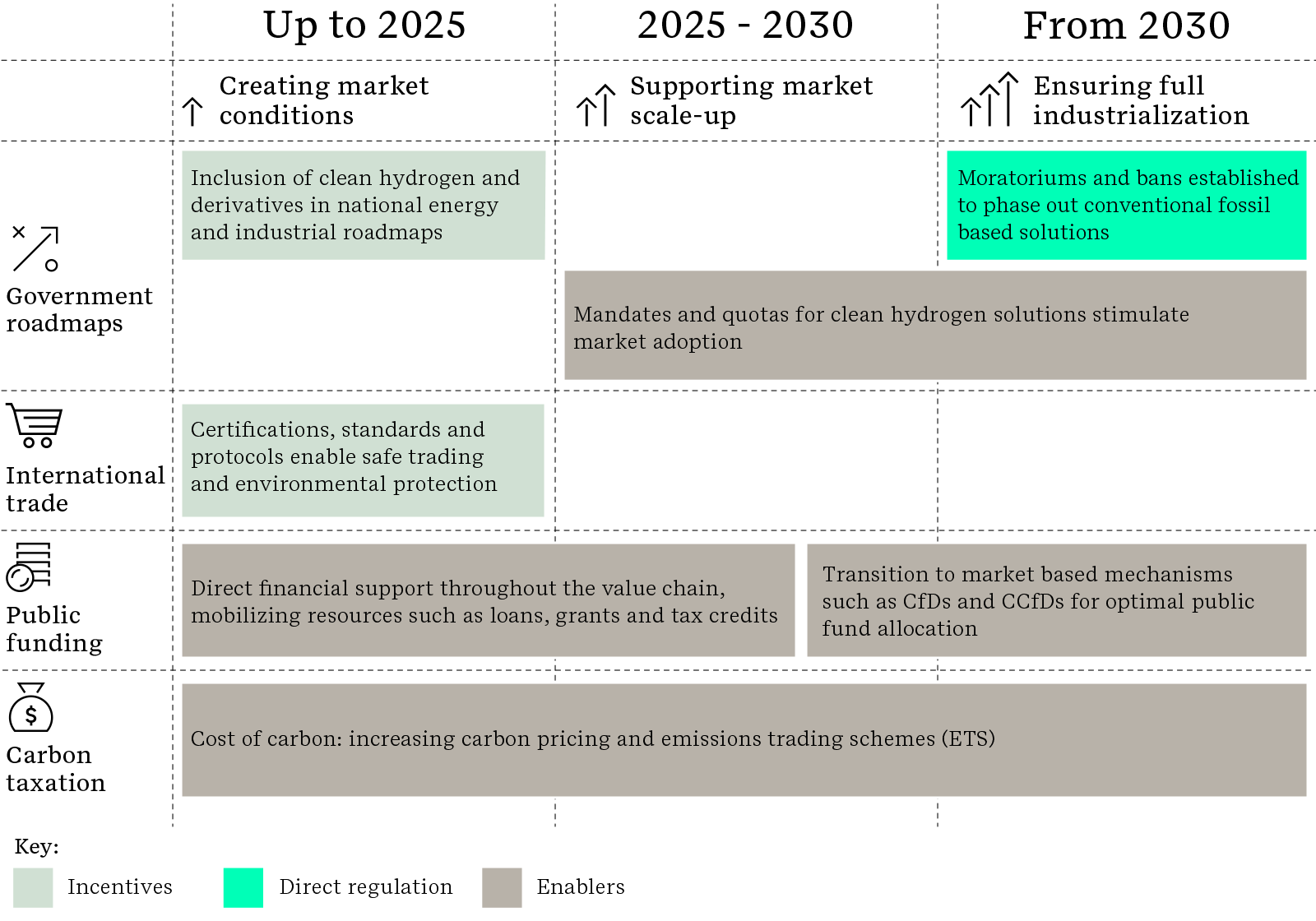

A number policy levers, outlined in the timeline below, will enable the clean hydrogen market to scale up by 2030 and fully industrialize beyond 2030. Oil & gas companies need to integrate these developments into their clean hydrogen roadmaps.

Figure 1: Timeline for policy instrument implementation

Source: ERM / WBCSD research

Government roadmaps – Policymakers are already starting to provide long-term visibility via national or regional hydrogen strategies that offer clear targets and measures to achieve these targets. These have taken the form of incentives, such as financial support or quotas for clean hydrogen consumption in heavy industry and transport sectors, or disincentives to discourage or ban fossil-based products that hydrogen replaces.

A growing number of countries are implementing such plans. The US is leading the way on funding, injecting $137 billion into low-carbon hydrogen over the next 10 years, mostly in the form of tax credits, and has published a National Clean Hydrogen Strategy and Roadmap, which establishes concrete targets, market-driven metrics and tangible actions to measure success. The US also launched a Hydrogen Interagency Task Force to advance a whole-of-government approach to clean hydrogen. Similar national plans have been launched by around 55 countries globally including Canada, France, Germany, the UK and China.

In the longer term, a greater use of legal measures such as moratoriums and bans will progress the replacement of unabated fossil-based feedstocks. This approach is taking effect in heavy transport, where regulators are focusing on discouraging the use of diesel trucks by implementing measures including emissions standards, carbon pricing and restrictions on use in built-up areas to drive adoption of low-emissions alternatives.

International trade - For low-carbon hydrogen to become a globally traded product, it urgently requires recognized standards to differentiate it from incumbents. Progress has been made in this area with the COP28 Declaration of Intent, which made the certification of renewable and low-carbon hydrogen and hydrogen derivatives a key priority for multilateral cooperation to unlock cross-border trade.

Concurrently, a new technical specification (ISO/TS 19870) was published by the International Organization for Standardization (ISO) as a foundation for harmonization, safety, interoperability and sustainability across the hydrogen value chain. The ISO’s Technical Committee on Hydrogen Technologies continues to work with industry experts to develop international standards for hydrogen to contribute to global market stability and certainty.

Public funding - As clean hydrogen production begins to scale, direct financial support enables early projects and significant funding for research and development will support improvement of hydrogen technologies.

In March 2024, the U.S. Department of Energy announced $750 million in project funding to advance electrolysis technologies and improve manufacturing and recycling capabilities for clean hydrogen systems and components, including fuel cell production to power medium- and heavy-duty trucks.

Policy strategies aimed at building market demand, transition towards the use market-based mechanisms that commit offtakers to purchase hydrogen on a long-term basis, such as Contracts for Difference (CfDs) or Carbon Contracts for Difference (CCfDs), where subsidies are allocated based on the difference between the production costs of low and high carbon products.

In March 2024, Germany launched the first auction for its €4 billion carbon contracts for difference funding programme, allowing companies from energy-intensive industries to apply for 15 years of funding for their largest transition projects. The US is also looking at a range of “demand-pull policies” including advance market commitments, prizes and Contract for Differences agreements.

Carbon taxation – Carbon pricing and cap-and-trade schemes generate funds that can be used to both support low-carbon hydrogen supply and incentivize demand for low-carbon fuels. Across all industries, moves are already being made in this direction.

The EU emissions trading scheme (ETS), which is being extended to apply to heavy transport in 2027, is redistributed to hydrogen project developers through Capex allocation, via the Innovation Fund, and Opex allocation, via the European Hydrogen Bank. This year’s pilot auction under the European Hydrogen Bank, for renewable hydrogen production in Europe, has proved successful, attracting 132 bids from projects located in 17 European countries.

In steel production, border tax regimes such as the EU Carbon Border Adjustment Mechanism (CBAM), can encourage markets for green steel, by penalizing high-carbon alternatives. Alternatively, measures could be created to enable consumers to claim tax offsets for products using green steel, under a certain carbon footprint threshold.

Scaling low-carbon hydrogen in the oil and gas sector

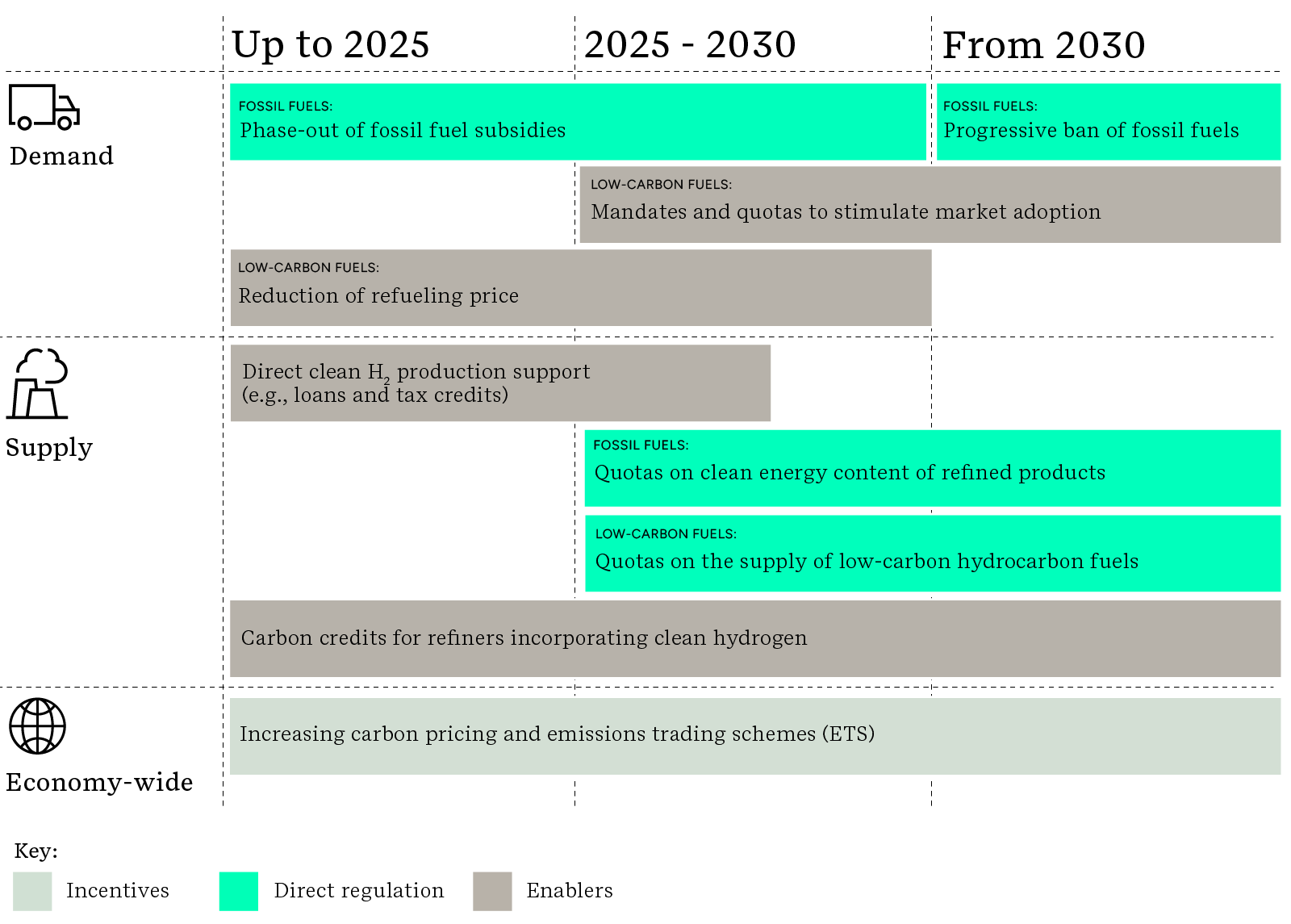

Policy strategies encouraging both demand and supply, outlined in the timeline below, will enable the oil and gas industry to pivot towards clean hydrogen production and use.

Figure 2: Roadmap for the adoption of clean hydrogen in the oil and gas industry

Source: ERM / WBCSD research

Government policies for stimulating clean hydrogen production and demand are increasingly being built and rolled out in conjunction with energy transition roadmaps. The EU is making progress in legislation to increase the integration of clean hydrogen into refining operations with the Renewable Energy Directive (RED III), which has established a binding target for the bloc to reach a minimum of 42% of hydrogen coming from renewable fuels of non-biological origin by 2030, rising to 60% by 2035. By meeting the RED III targets, oil and gas companies will be exempted from paying carbon taxes via the EU ETS.

Mandates to supply hydrogen fuels are also key. Last year the European Parliament and Council agreed on new rules to decarbonize the gas market and create a hydrogen market. These include plans to integrate renewable and low-carbon gases, including hydrogen, into the existing gas grid, supported by discounts to cross-border and injection tariffs, plus a low-carbon gas certification system.

To accelerate clean hydrogen adoption in the oil and gas sector, industries up and down the value chain require supportive policies and mechanisms to provide offtakers with certainty about the availability and affordability of low-carbon hydrogen and stimulate a sustainable market worthy of greater investment in hydrogen production and supply. With this support, hydrogen has the potential to emerge as a viable decarbonization option for both oil and gas and other harder-to-abate sectors over the next decade.

These insights are derived from the recent report, Policy Strategies to Grow Decarbonized Hydrogen Demand, co-authored by ERM and the World Business Council for Sustainable Development (WBCSD).

Author contacts

Loic Le Gars - Principal Consultant, EMEA

David Hart - Partner, EMEA

Neeraj Nandurdikar - Global Service Leader, Capital Project Delivery